Owner Guide: How to Collect Occupancy Tax on Airbnb

UPDATE Jul 17, 2019: Yes, owners shall collect GE and TA taxes on cleaning fees in Hawaii

After more research, calls to the Hawaii Department of Taxation and a consultation with the Rental By Owner Awareness Association, the verdict is – all vacation rental property owners and managers in Hawaii must collect and remit taxes on cleaning fees. Refer to the Tax Facts brochure, revised in February 2019, section 4: “… gross rental proceeds do include fees, such as maintenance fees, cleaning fees, and management fees, that are not usually charged separately to guests or tenants.”

Example: The cleaner charges $125 for the clean, adds $5.21 GET to it and bills $130.21 to the owner. The owner quotes $130.21 to the guest (or $130 even to make the fee look simpler). The quoted cleaning fee is added to the gross rental proceeds, and is taxed at the corresponding combined GE and TA tax rate (on Maui 14.4166%), which is an additional $18.74 for $130 cleaning that the guest will have to pay.

UPDATE Apr 25, 2019: Shall I charge Hawaii taxes on cleaning fees?

The original article below was written before Airbnb introduced the “Added Taxes” field to their listings (at least for Hawaii), and it was intended to help owners stay compliant with Hawaii tax laws and collect the taxes even though they were not reflected in the quote.

We are happy that Airbnb finally caught up with Hawaiian tax collection requirement, and introduced an “Added Taxes” field. To find it, select your listing, click on “Local laws” in the menu under the listing name, and scroll down to find “Local tax collection” section. After you enter your Occupancy tax there – in Hawaii, it’s a sum of General Excise Tax (GET) and Transient Accommodations Tax (TAT) – it will be displayed in the quote to your guests.

Airbnb collects this tax on both the rent and the cleaning fee. While there is no real tax law about GET and TAT, Hawaii Department of Taxation issues publications with explanations. Unfortunately, the language in them is not very clear.

In the recent Tax Facts 96-2 edition of February 2019, in #4 it says:

“… gross rental proceeds do include fees, such as maintenance fees, cleaning fees, and management fees, that are not usually charged separately to guests or tenants.” One can interpret that the cleaning fee should be always included in the gross income and taxed, and another can say that if the cleaning fee is stated separately, it gets visibly passed through to the cleaners who pay their GET tax on it.

Note that this Tax Facts publication is about the TAT, but what about the GET? Who pays the GET? The cleaners must always pay the GET, so they normally bill owners for the cleaning fee + GET. But if owners have to add GET and TAT to this, it means double taxation of GET, plus the second GET and TAX are applied not only to the cleaning fee but to the first GET amount, paid by the cleaners.

For example, if a cleaner charges $125 for the clean and adds $5.21 GET to it, then the owner can simply collect $130 from the guest and pay $130.21 to the cleaner (and endure a small loss of 21 cent to make things simpler for the guest). If the cleaning fee is taxed, this adds 14.4166% (in Maui) to the $130 cleaning fee in the quote, which is $18.74. The guest would pay quite a lot in taxes in this case, and it doesn’t seem fair with the double taxation.

We called a couple of CPA’s and talked to owners and property managers – the opinions are divided. Some collect the taxes on the cleaning fees and some – don’t. As an owner, you’ll have to make your own decision whether to collect Hawaii taxes on cleaning fee or not.

UPDATE Feb 8, 2019

Hawaii said, Airbnb has acknowledged that hosts were not paying all taxes. Hawaii’s attorney general has asked a judge to allow the state to subpoena Airbnb to help it find which hosts haven’t paid the state’s equivalent of hotel and sales taxes.

Original Article: How to Collect Occupancy Tax on Airbnb

This article was written at the time when Airbnb didn’t have a dedicated field to enter the occupancy tax for Hawaii, and it was impossible to include the taxes into the quote. So, we described the workaround here.

Unlike other portals (VRBO, FlipKey, etc.), Airbnb doesn’t provide owners with any means of entering the percentage of the occupancy tax they need to collect. Most of owners are familiar with VRBO’s interface – it’s a simple box where you type the percentage of occupancy tax for your property. We never understood why Airbnb can’t or doesn’t want to implement such simple and obviously needed feature. We hope that this Owner Guide: How to Collect Occupancy Tax on Airbnb will help owners resolve this tax collection problem. And not just in Hawaii; the same method is applicable to any other locality.

All information in this article applies to individually owned rooms, condos and homes in Hawaii that can be legally rented as transient accommodations, i.e. rented to a transient person for less that 180 consecutive days.

For an adequate introduction to Hawaii Tax law, we recommend the following 3 brochures from Hawaii Department of Taxation:

An Introduction to Renting Residential Real Property

An Introduction to the General Excise Tax (GET)

An Introduction to the Transient Accommodations Tax (TAT)

What is important to understand for the purposes of this article, is that Hawaii tax law requires that the owner explicitly informs the guests of the amount of the GET and TAT at the time of the quote. On the bill, the GET and the TAT must be stated separately. And that’s not currently possible in Airbnb, because they don’t provide owners with a form to enter tax they have to collect.

There are two possible solutions.

Solution 1 – Wrap Occupancy tax into Airbnb rates

That’s wrong for 3 reasons:

1. If you don’t raise the rates, you will pay the taxes out of your own pocket.

2. If you do raise the rates, you now have much less chances to get booked. Even if you say in the listing, that taxes are included, not everyone reads descriptions.

3. In both cases, you would not be complying with Hawaii tax law.

Solution 2 – Collect Occupancy Tax as a separate Airbnb payment

That’s the right thing to do. You will comply with both Airbnb occupancy tax policy and Hawaii Tax rules. In addition, you will not have to pay this tax out of your pocket. Let’s see Airbnb’s position on this and how to implement this tactic efficiently.

Googling “how to collect occupancy tax on airbnb” brings up the following from Airbnb’s website:

“As an Airbnb host, if you determine that you need to collect occupancy tax, you can collect Occupancy Taxes by asking your guests to pay it in person or through the Resolution Center after they check in. In each case, it’s important that guests are informed of the exact tax amount prior to booking”.

https://www.airbnb.com/help/article/654/what-is-occupancy-tax–do-i-need-to-collect-or-pay-it

Well, with Instant Booking it’s not possible to inform the guests “of the exact tax amount prior to booking”. For most of owners it’s not feasible to collect the tax in person either. But we can definitely inform potential guests that we have to charge Hawaii tax separately and request this separate payment through Resolution Center.

Step 1 – Inform travelers, that you have to collect Occupancy tax

We will place this information right at the top of the listing’s description, so it’s clearly visible. It’s necessary whether you have Instant Book On or Off. because if guests are not happy and demand a cancellation for the reason you haven’t informed them about this additional charge, it might cause you problems.

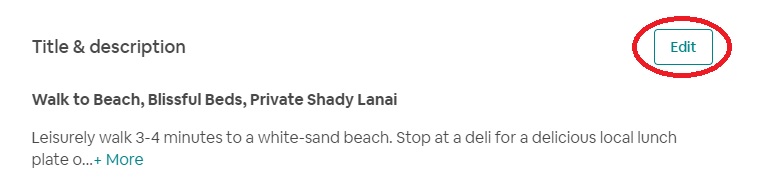

Login into your Airbnb account, and select the correct listing. You should be on Listing Details page. Scroll down until you see Title & Description, and click Edit.

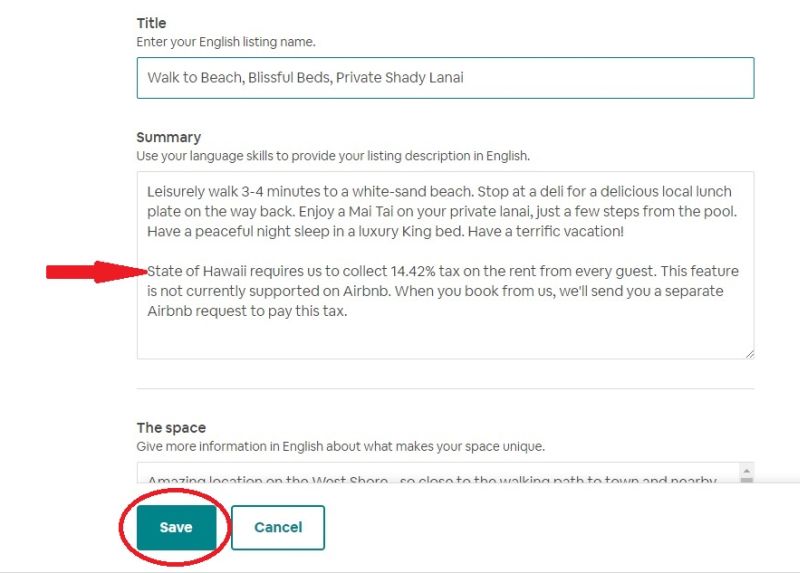

Your first paragraph of the Summary should be enticing and show all the main attractions of your vacation rental property. Right after that, write a paragraph about your occupancy taxes and how you collect them. Click Save.

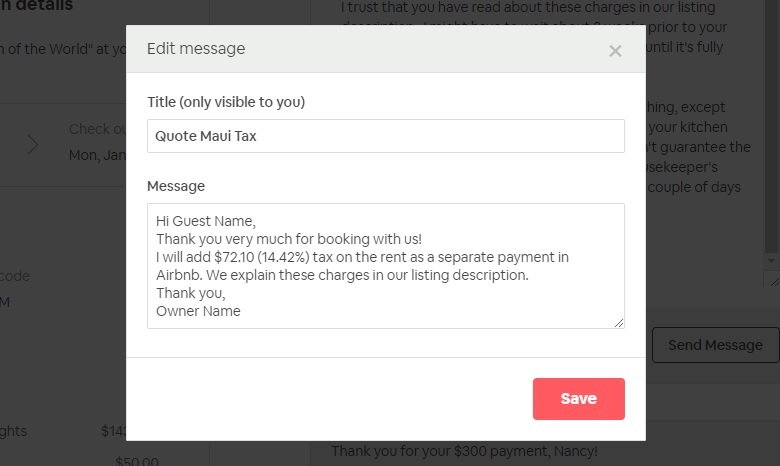

Step 2 – Quote Occupancy tax to every Airbnb guest

Whether you receive an inquiry or an instant booking, make sure to quote the exact amount of Occupancy tax you will collect as a separate payment in Airbnb. You can save a message in Airbnb and use it as a template any time. Here is our template, we just need to replace the tax $ amount and the message is ready to be sent in seconds.

Step 3 – Collect Occupancy tax from every Airbnb guest

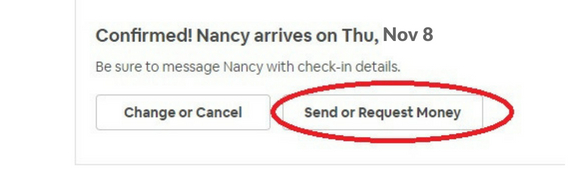

Go to the Message History of your Airbnb Reservation, and click Send or Request Money button at the top of the screen.

On the 2nd screen, choose Request money. On the 3rd screen, choose Other trip-related issues. On the next screen, enter the $ amount of the tax you collect. On the next screen (Upload photos), click Skip. Finally, write a note – “14.42% Hawaii tax”, and submit the request.

A very useful link to Airbnb Resolution Center:

https://www.airbnb.com/resolutions/

Here, you can view all your requests and see their status – paid or not.

Important note

Until recently, it was very simple. 10 seconds to send a message with the tax amount quote, and 30-40 seconds to enter the request to pay. Done!

But then Airbnb decided to not charge travelers everything upfront. Many of the travelers now pay partially right away, and the rest is paid two weeks prior to arrival. Airbnb will not accept additional requests to pay until the reservation is fully paid. So, you will have to remember / set a reminder to request the tax payment 13 days prior to arrival. HomeyHawaii booking management system has automatic reminders that can be configured to display due events on your dashboard and to email you reminders.

Conclusion

For our own Hawaii vacation rentals, we are happily collecting Hawaii tax on Airbnb as a separate payment. With the help of HomeyHawaii booking management system, we are reminded at the right time to to do the right things and it literally takes minutes to send messages, request and collect payments, and also report collected taxes to Maui county.

More and more owners are catching on it. And the more owners jump on the bandwagon and start doing the same thing, the more Airbnb guests will get comfortable with the idea of having to pay the occupancy tax.

Happy rentals!

13 thoughts on “Owner Guide: How to Collect Occupancy Tax on Airbnb”

Thanks for the work-around to the Hawaii/AirBnB problem. However, your suggestion does appear to contain one error. The Hawaii tax laws state that the amount of GET and TAT taxes be shown as SEPARATE items on the tax bill, so your instructions to indicate a $72.10 (14.42%) tax in the message area are incorrect by my interpretation. To comply with the tax laws I believe it should state $20.85 (GET 4.7%) & $51.25 (TAT 10.25%). Or am I missing something?

Hi Sue, thank you very much for your comment!

Technically, you are correct. Practically, the solution to list both taxes together is good enough. We spoke with Maui tax department on the phone last year, at the time we developed the tax calculation report for HomeyHawaii, and the representative confirmed that it’s enough to wrap both taxes together, as long as you show them separately. If you collect other fees, such as cleaning fee, and your cleaners charge the GE tax, you can just list your cleaning fee with this GE tax included. On your personal tax return, it’s a deductible item (both the fee and the tax), so why separate them?

Besides, it’s much cleaner and much more palatable to guests when they are not nickel-and-dimed for services.

Owners have enough on their hands already. We advocate making things as simple as possible and as uniform as possible across all owners.

Aloha.

Aloha we have been using your suggested method. Curious what would happen if a guest did not pay the additional requested amount?

Aloha,

Here is the direct link to the Resolution Center (you have to be logged in to see all your requests):

https://www.airbnb.com/resolutions/

You can click View Details button to view the details on every request.

When your request to pay is not paid within 72 hours, another button will appear on the Details screen that will say something like Request Airbnb Assistance. This is where you can involve Airbnb to help you get the payment from your guest.

It has never happened to us so far. We have a very explicit statement about this as the second paragraph in property description. Sometimes the guest doesn’t see the request to pay for some reason. A couple of times we had to call the guest directly to inform that we have requested the tax and to remind to pay.

I am still unsure on the cleaning fee. Must I collect both GET and TAT on the cleaning fee, or only on the rental portion? Airbnb seems to indicate that we have to pay GET and TAT on the rental portion, the cleaning fee, and also the 3% they withhold from us.

Hi Gary, thank you for your message.

It has always been our understanding that owners don’t have to collect taxes on cleaning. This article was written before Airbnb introduced the “Tax” field to their listings (at least for Hawaii). I am going to update this article right now with recent developments, please check it out and decide for yourself, as we don’t have a straightforward answer to this at the moment.

According to the “Introduction to Transient Accommodations Tax” brochure published by the State of Hawaii, both transient and excise taxes are paid on the gross rental receipts.

To quote:

4. What is included in gross rental income?

However, gross rental income does include fees, such as maintenance fees, cleaning fees and management fees, that are not usually charged separately to guests or tenants.

For Excise tax Gross Rental Receipts are described as any charges passed on to the guest, which would also include cleaning fees.

So, as much as I often disagree with the way AirBnb handles things, it seems to me they have it right in this case.

Have you used and collected with the new tax field on Airbnb for Hawaii? So far, they have been short changing me and even though I’ve specified to collect 14.96% (Oahu), I’m only receiving 9.79% on my latest booking.

We received a few bookings with the taxes included (14.42% Maui tax), but we haven’t received the disbursement of the first one of those yet. The numbers were correct in the quote. Why don’t you call Airbnb to find this out?

I’m confused as to the part where airbnb is now collecting taxes. Months ago I added our tax ID in the appropriate field on the ‘local laws’ tab, but I have never seen taxes accounted for anywhere in any of my bookings. I also did a request to book our place and I see only a nightly rate, cleaning fee, and service fee.

Hi Rob,

Did you try to call Airbnb? Some support people know more than others, but you might get lucky. I didn’t have problems with updating the tax licence number and starting to collect taxes in quotes, but some owners did.

Is my formatting incorrect?

License or registration number

Make sure the number you enter is accurate. Using this field for any other purpose, like personal contact information, could get you removed from Airbnb.

license or registration number

167-566-3872-01

I don’t think there are strict rules, and yours seems fine. Some owners write T-167-566-3872-01, others – TA-167-566-3872-01. You can look up you license online:

https://portal.ehawaii.gov/business/tax-services/tax-license-search/

and they use T-167-566-3872 format.

We have TA-999-999-9999-99 format on HomeyHawaii listings, and this is the one I use for our personal listings on Airbnb.