Why You Need Travel Protection for Your Hawaii Vacation

Many people travel during their time away from life’s obligations. From visiting relatives to going abroad to see new lands, we tend to go and want to enjoy the trip to the fullest. This is especially true when we go across seas, as we don’t want to have to worry about such things as where our luggage is or what happens if a flight gets canceled. However, these things can happen. A flight becomes delayed or a medical emergency comes up that needs to be addressed. So, what do you do? You say thank you to Travel Protection for always having your back.

Travel protection is a blanket policy for your trip that will help you in case something goes wrong during your travels. Depending on where you go and how you get there, having sufficient travel protection can put many of your problems to rest.

Let’s consider just a few situations that can arise before or during your vacation to Hawaii, and in which a Travel Protection policy will help you keep your money.

1. Trip Cancellation

Everything is set. The family trip is planned for Honolulu, and it is just hours from take-off. Suddenly, your mother calls and says she can’t go because she’s sick. Once she’s out, so is everyone else. Suddenly, you’re left with a non-refundable deposit and prepayment. Who can help with the reimbursement quickly and professionally?

2. Lost, Damaged or Stolen Luggage

You just arrived in Hawaii. Everything seems great until you find that your luggage is missing. Who can you call to help find your bag or help you recover the cost of replacement items?

3. Medical Emergency

You are just a few days into the trip and everything is going smoothly. Suddenly, you feel extremely sick or get injured on the trail or during snorkeling and need to be hospitalized. Who do you contact to help with the extra expenses on this trip?

4. Trip Interruption Due to Weather

Relaxing, tanning, and soaking up the sun. Sounds like the perfect stay on the beach, until a warning goes out and you must be evacuated due to an impending hurricane. Remember Hawaii hurricane season of 2018 with 6 hurricanes ranging from Category 1 through 5?

Or, it’s raining cats and dogs and your vacation area gets evacuated due to mudslides. Remember the historical downpour and mudslides on Kauai in spring 2018?

Now you are stuck in unfamiliar areas with no one to help you. Who gets you out? Who refunds you for the lost beach days? Weather cancellation protection becomes especially important as the Earth’s climate becomes wilder and less predictable.

5. Flight Cancellation

You just got off of a long flight to the connecting airport. Your family is dog-tired and just wants to get on the next flight to head home to rest. However, your connecting flight home just got cancelled. Who will help you get a flight back home?

While many believe they will never be put in these types of situations , the reality is that they happen every day, especially when you least expect it. From minor inconveniences, to major let-downs and emergencies, problems can occur at the drop of the hat. Always having a quality Travel Protection plan will help ensure that, no matter who you see or what you do, someone has your back when problems hit the fan. That’s why we highly recommend to always consider your options for travel protection.

Basic Travel Protection with Credit Cards

Otherwise known as trip cancellation protection, it comes as a benefit on many credit cards. With this you usually get covered for lost bags, missing connections and cancellations due to sickness. If you are going to pay for your vacation with a credit card, check you wallet and hop online to find out the cancellation protection on your card(s) and maybe check with you bank to see if they offer a newer variation with better coverage.

Because of COVID-19 pandemic, you might not be able to immediately redeem the points or use the benefits. Still, you can start to collect points to use for your future travels. Some cards have already adapted to the ongoing situation and began to offer additional useful benefits. Find a thorough breakdown in the Best Travel Credit Cards of 2020 article by Money.com.

Comprehensive Travel Protection with Independent Insurance

A well-designed comprehensive travel coverage will include all the basic benefits discussed above, plus more coverage for emergency medical care, evacuation and repatriation, trip cancellation/interruption and baggage loss and delay. Their 24/7 professional worldwide assistance will be invaluable should you ever find yourself in an emergency situation on vacation.

Our partner insurance Arch RoamRight continues to cover losses for all trip cancellations on policies bought prior January 21, 2020. As of January 21, 2020, the Coronavirus was recognized as an epidemic and became a known and foreseeable event. As such, travel disruptions due to Coronavirus are not covered under most standard travel insurance policies. Despite this, we highly recommend obtaining a travel protection policy, as all other potential interruptions of your travels plans remain in place.

Buy your travel insurance on HomeyHawaii.com.

How to Both Save and Get Travel Protection

Make it simple, make it cost-based. Let’s do some quick math for a simple primer.

If you are booking a hotel, you will definitely be able to pay with a credit card, and hotels often offer free cancellations for up to N hours. But a simple Hawaii hotel room without a kitchen has a high cost. The average nighly hotel room rate in Wailea in July 2018 was $674.

If you are booking a vacation rental property, you might book it directly from owner and save quite a lot, sometimes half of the nightly rate. Not only will you save for the most comprehensive travel insurance, you will also get a fully equipped kitchen that will keep you even more of your food budget.

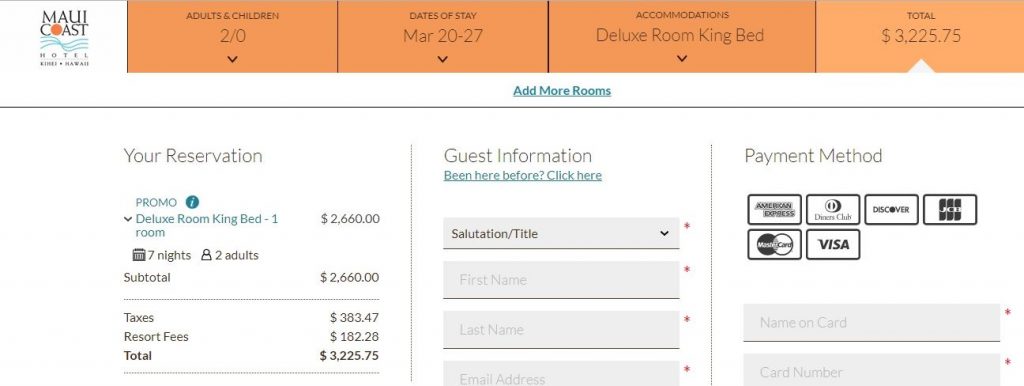

Let’s take a non-luxury option and compare apples to apples. Compare Maui Coast Hotel and a 1-bedroom Kihei Kai Nani condo, both located in Kihei, Maui just across the road from most calm and swimmable Maui beaches. Here are two respectable quotes for a week of March 20 – 27, 2020 for 2 adults.

This is $3226 for a room in Maui Coast Hotel, no kitchen versus $1694 in 1-bedroom in Kihei Akahi with more space, fully equipped kitchen and 2 additional twin futons for up to 2 more people. Even for just two adults, it’s a saving of $1532. Let’s take a look at a sample quote from RoamRight, a great travel insurance that we partner with, for those two adults (50 years old, coverage $2000 for both persons).

So, you’ll get the best travel protection for $110 and it will leave you $1422 more to spend on activities and amusements. Peace of mind plus extra cash – seems like a total win!

Some vacation rental owners accept credit cards, and some don’t or they will ask you to pay the %3-5% credit card fees. Those details don’t matter by themselves. What matters is the final price, the quality of your accommodation, and the quality of your trip protection. Focus on those 3 variables and select what’s right for you.

Ready to travel to Maui? Find your dream Maui vacation rental and check out our Maui Travel Guide to get well prepared.

Whether it be through a credit card company or independent insurance provider, protect your vacation from cancellation, interruption and other adversities.

A broken arm on vacation shouldn’t cost you another one.